In this article: Technique: NFT

NFTs - the hype

Suddenly people buy art anonymously in the form of NFTs (Non-Fungible Tokens) on "marketplaces" on the Internet, which - compared to classic galleries - can hardly be described as an art business.

And it's not about a few euros, but about millions. The "Nyan Cat" by Chris Torres, for example, a meme that flooded the Internet ten years ago, copied a thousand times over, has now been sold as an NFT (non-fungible token) for just under $ 600,000.

The graphic designer Mike Winkelmann aka Beeple has been publishing a new work of art every day since 2007 and has 1.8 million followers on Instagram. In December 2020, he raised $ 3.5 million for 20 of his works at Nifty Gateway, a digital art marketplace. The Beeple collage "Everydays: The First 5000 Days" is composed of these 5000 photos as a single JPEG with a size of 21060 X 21069 pixels. The individual works of art can be viewed free of charge on Tumblr - but the NFT collage generated 69,346,250 dollars after a two-week auction.

What are NFTs?

The abbreviation NFT stands for Non-Fungible Token and describes a process in which the ownership of an "object" is clearly defined and the "object" is also clearly identified. This becomes a little clearer with the following example: If someone is loaned € 10 in the form of a corresponding banknote, you are not expected to get the same note back. Another € 10 note or five € 2 coins or similar could be used to settle the debt. In such a case, one speaks of FT or Fungible Token. If you lend someone valuable jewelry for an evening event, however, you expect to get it back. Perhaps one concludes a contract about the award, in which the parties are named and the subject is described in detail. Now the jewelry becomes an NFT, a non-fungible token that is non-exchangeable. It looks similar in the digital world, but what do I actually get if I bid or buy the NFT of a virtual property? From a technical point of view, a contract is concluded between a provider and a buyer for a digitally available object that is (almost) unalterably sealed in a blockchain. This would determine the property rights, but not necessarily the property rights.

This does not explain the "Beeple Mania" the NFT-Run, which meanwhile leads to more and more marketplaces for digital products or combinations of digital and real products, on which NFTs can be bought or auctioned. For June 2021, for example, Binance, one of the largest crypto exchanges, has announced that it will offer its own marketplace for NFTs. And the energy consumption for creating an NFT is also considerable, if you take into account the electrical energy required to mine first-generation blockchains such as Bitcoin or Ethereum 1.0. But with the introduction of Ethereum 2.0 in 2022 at the latest, this argument will weaken considerably, since the currently necessary mining (proof of work, POS) will then be replaced by the significantly more economical Proof of Stake (POS) process. More modern blockchains such as Cardano (only POS) are already planning the introduction of marketplaces for NFTs this year.

But to better understand the trend towards NFTs, let's look at a few of the positive effects that are bringing buyers and sellers into the NFT world.

Buyer:

The "NFT" construct primarily serves the desire to be the sole and incontestable owner of a digital product that has perhaps already been copied and pirated a thousand times. The owner of the NFT can now be indifferent to past and future processes of copying, changing and stealing "his" digital object, because the NFT is unique and can no longer be changed or falsified. However, as a buyer you should be aware that usually neither copyrights, trademarks, copyrights or the "sole" ownership is transferred. However, variants are also offered on marketplaces that include or exclude copyright, for example.

Seller:

If the provider of the NFT is the artist himself and not a reseller, converting a "digital object" into an NFT can reduce the fear of unauthorized copies. NFTs should not be confused with copy protection, but after "mining" e.g. a digital photo in a blockchain, there is now a clear assignment between the photo and the NFT. The photo itself is not stored in the blockchain, but e.g. the location where it can be downloaded is specified. In order to be able to clearly identify the digital object, it is advisable to create the hash value of the photo, from which the digital photo can be clearly reproduced again, in order to completely prevent subsequent changes to the NFT object.

So how do you create an NFT from a digital photo?

The IPFS, the Inter Planetary File System, offers an elegant way of uniquely identifying a digital photo. One of the goals of the IPFS is to replace the current Internet standards. My example photos shown in this post are available as cryptographic hash values that can be called up via your IPFS address. This has two advantages. On the one hand, the uniqueness. If the digital photo is generated from the hash value, no pixel has changed compared to the original digital photo. On the other hand, the IPFS uses a distribution structure called "Merkle Trees" or IPFS DAGs, so that a hash value stored once on many servers worldwide can be reproduced again and again.

It cannot disappear like a digital photo, which in the current Internet, the Web 2.0, is only stored on a single server and is lost if that server fails.

Websites can also be created in IPFS, Web 3.0. The Tenckhoff photo archive can already be accessed via this link in the IPFS: https://gateway.ipfs.io/ipns/k51qzi5uqu5dlswaf2027yocsm85og9k8160ma99ziejaemu76ea85m1ouh26u/

The IPNS provides the well-known DNS functionality of Web 2.0 for the IPFS. In this way, IPFS websites can always be reached at the same address, even if changes to these pages have become necessary.

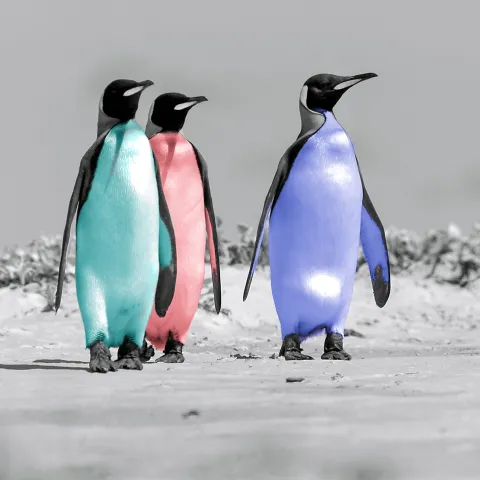

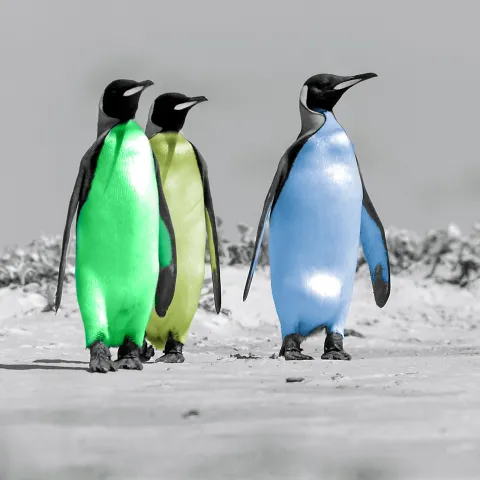

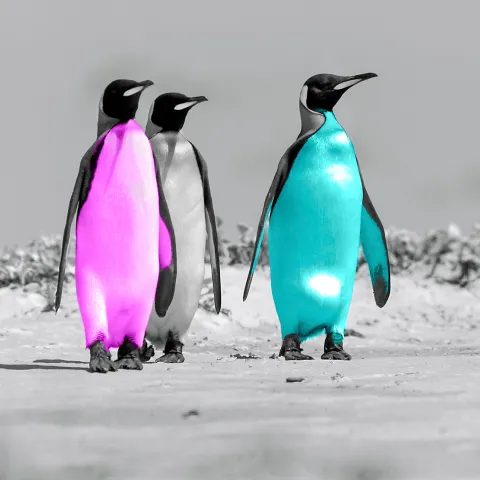

Our collection as GIF The 9 penguin pictures as GIF

Various choices can be made during the process of creating an NFT in a marketplace.

- Do you want to auction your NFT or offer it at a fixed price?

- How many copies of a digital image do you want to offer?

- How high should the price be?

- How much - in percent - do you expect if you resell an NFT that has been sold once?

For this post I produced 9 digital images based on a digital photo of 3 king penguins that I took in the Falkland Islands. The three penguins entered the Photoshop lab and left nine times in different color combinations.

Cryptographic hash values were generated from each of the nine photos (on a Raspberry PI with installed IPFS client, it is also direct and easier via services such as Pinata, so that they can now be called up in IPFS at the following addresses. An overall view as a hash value can be seen here:

https://ipfs.io/ipfs/Qmf5RMNxygck4ccL3E175hQeaEYAPEXHQ9gWeDaLSNL8S8

The individual recordings are stored in the IPFS under the following hash values. The corresponding NTFs were produced from this.

In the next step, Rarible NFTs were produced from them on the Internet NFT marketplace and you can now see and purchase them in my portfolio on the Rarible NFT marketplace. For this you need

- An account with Rarible

- A wallet such as Metamask is available as a browser extension for Firefox etc., in which the necessary crypto currency, here Ethereum, is available.

If you follow the inserted link, you will come to my "Penguin Collection on Rarible", for which I offer 10 copies of a photo at a fixed price. Whether or not there are auctions should be made dependent on your level of awareness and - above all - on the followers of the respective marketplace or your own.

For those who want to try out the creation of an NFT without incurring any costs, the mintable marketplace is ideal. Here you can set your NFT in the "Gasless" collection without incurring NFT generation fees immediately. The costs only arise in the event of a successful sale, so it makes sense to include them in the product price. (Supplement November 2021: You can now also mint "gasless" on Rarible)

My first test on Mintable can be viewed here: Penguins on Mintable

State of the art: Modern blockchains, e.g. from Cardano and Solana, are increasingly presenting themselves as serious competition for Ethereum. To verify transactions or mine NFTs, they no longer use the Proof-of-Work (PoW) mining process known from Bitcoin and which is often criticized, but instead rely on the much more energy-saving Proof-of-Stake (PoS) and Proof-of-History (PoH) methods. These require significantly less electrical energy, so that the ecological footprint can be assessed as significantly more favorable. The Cardano blockchain is also based on current scientific methods. The currency on the Cardano blockchain is called ADA (after the mathematician Ada Lovelace) and can be purchased at many trading venues or banks for, for example, € or US$.

The global crypto community is growing continuously and the younger generation in particular have few problems navigating the complex world of blockchains, wallets, NFTs, etc. So it is not surprising that the majority of those who own and buy NFTs are born in 1981 or later. A good reason for "older people" to find comparatively simple and structured access to this rather complicated digital world via NFTs.

If you want to protect your cryptocurrencies, consider a secure hardware wallet from Ledger or Trezor.